Will Canadian Interest Rate Increases Crash Calgary's Market?

Is it all over?

Is it all over?

Are the rising interest rates in Canada the biggest threat to Calgary's real estate market over the next couple of years?

Lately, our team has been having several conversations about this topic with clients, reporters, and local magazines, and now, we want to put the record straight.

More than what the news headlines say, you need to look at two important factors to understand what is happening in the market. First, you need to analyze how interest rates change historically, then study the current supply in the market.

Interest Rates

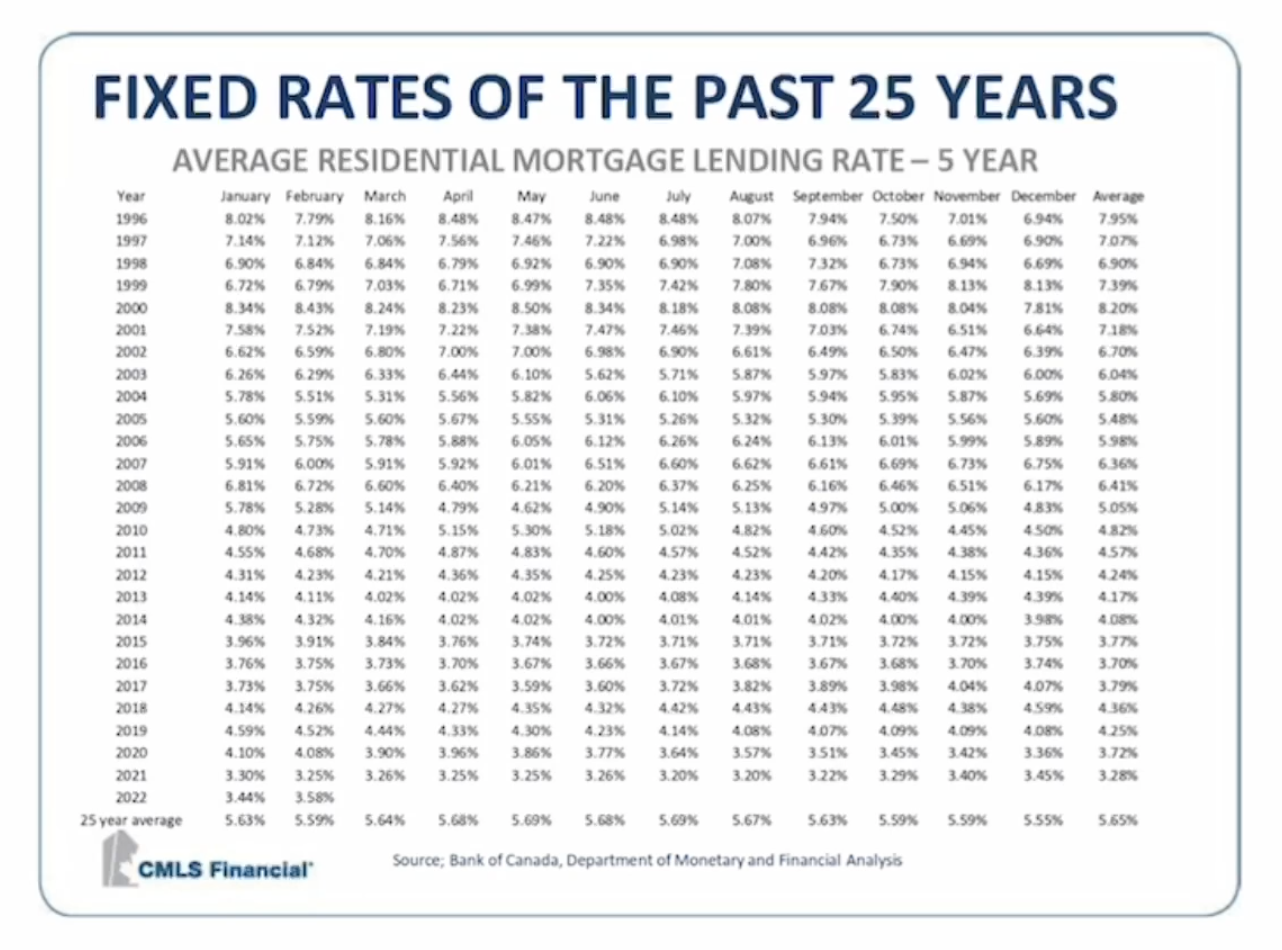

Lindsay Labrecque, a mortgage broker shared historical information with our team to talk about the changes in interest rates this year.

Back in 1980 prime was sitting at 20%, then it went down to 11.25% in 1991.

The average residential mortgage lending fixed rate over the last 25 years is 5.65%. You can see drastic changes in the numbers from 7.9%, 8.2%, 5.9%, 6.4%, 3.7% to 3.28%.

The variable rate tells the same story. The average variable rate for the last 25 years is 4.38%.

Typically, there is about a 1% difference between the fixed and variable interest rates. However, the last two years have been dramatically low.

As the world goes through a global pandemic that brought so many changes in the way people do business and activities, the market has seen unbelievably low variable rates such as 1.8%, and even 1.2%.

Now that things are falling back into place, interest rates are going back to what they should be. Because of this, some buyers who aimed to buy a house on a fixed rate mortgage may be pushed into variable mortgages.

Types of Variable Rates

There are two different types of variable rates, Adjustable Rate Mortgage and Variable Rate Mortgage. On the adjustable side, the monthly payment changes with every rate adjustment. On a variable rate mortgage, the total payments remain fixed for the duration of the term, principal, and interest allocation changes. That means your payment and interest adjust instead of the total payment changing.

The current formula to qualify for a fixed rate mortgage is the purchase price plus 2%. This is the reason why some buyers are getting pushed into the variable rates because the qualifying rate to get a mortgage is less than what the qualifying rate is for a fixed mortgage.

Looking at these numbers, is it enough to say that the Calgary real estate market is in jeopardy? No. That’s the simple answer.

Sales vs New Listings

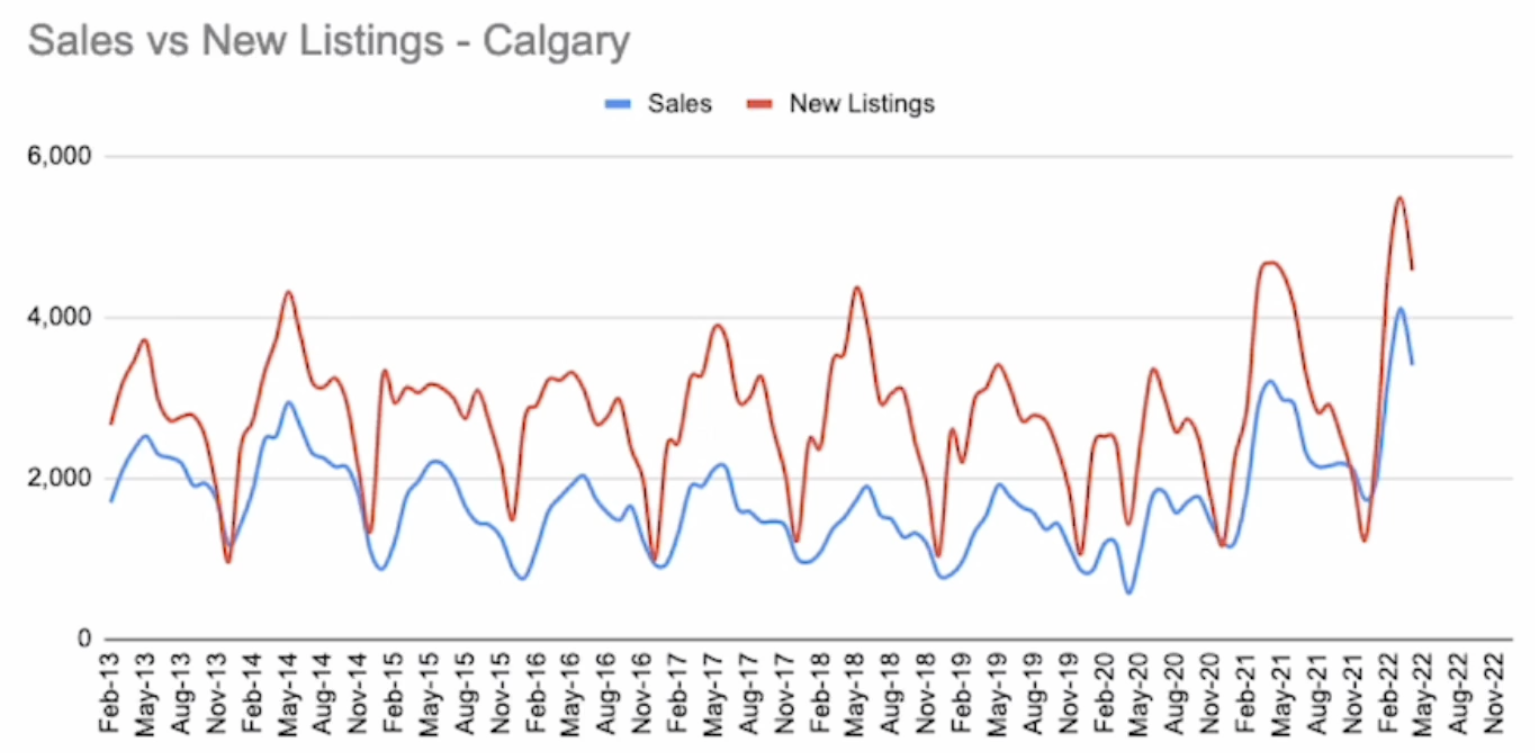

As a team of experienced realtors, we can see that the interest rate is not the real problem. The problem is the market that we are in. There is a real lack of supply to meet the increasing demand.

Right now, the Calgary real estate market has more sales than new listings, so prices have been increasing too. The months of inventory for the whole city is very low.

The city is sitting at 1.4. months of inventory. The last time it dipped down below 2% was back in spring 2014, and that was also the last time we saw price increases.

Supply

So why is supply a problem?

Back in 2013 and beyond, many people bought homes. For some homeowners, there is just not enough motivation to sell their homes yet. On the brighter side, you can expect sellers to offload their properties over the next spring and fall, or up to next year.

Another reason for the lack of supply is the overwhelming demand coming from out-of-town buyers. In 2021 and into 2022, Calgary was the number one location in all of Canada for one-way U-Haul bookings. That is a clear indicator of the number of people migrating here and needing a home.

The other part of it is the baby boomers. Many seasoned couples who are now empty nesters are staying in their family home longer. In most established communities, you can easily find big houses with only one or two adults living in them because they have not decided to downsize yet.

Lastly, the market has not seen strong price increases, like what is happening right now in a very long time. It is really interesting to see what the market will look like as we move forward in the coming years. This is the reason why some are still holding off from selling as they watch what will happen next.

Towards the next coming months and years, there is a good chance that you will continue to see multiple offers happening in our city due to the current market trend. If you need help in understanding market data to guide you in making an informed decision, book a call with us. We will be happy to help you and walk you through the entire process.

Posted by Jared Chamberlain on

Leave A Comment